Find home energy rebates and start saving money on energy.

We understand that making home energy efficiency upgrades or repairs can be a costly investment. That’s why we’re offering rebates on eligible upgrades that can add up to over $5,000 in savings.

Explore money-saving rebates.

If your home’s important systems — like heating, air conditioning and water heating — are over 10 years old, or you live in an older home, energy efficiency upgrades can help you lower your monthly energy bill, increase indoor comfort and use less electricity.

Geothermal Heat Pump

Mini Split

Heat Pump

Central Air Conditioning

Duct Sealing and HVAC Tune-up

Air Sealing and Insulation

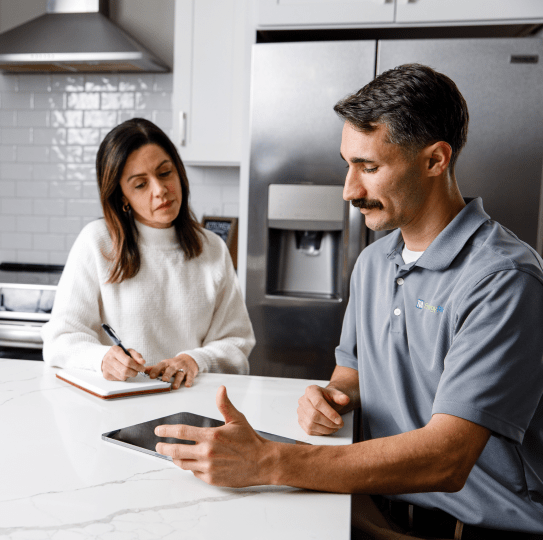

Access rebates through the Quality Contractor Network

TVA-vetted contractors from our Quality Contractor Network* complete all rebate-eligible upgrades, and they’ll even submit your rebate for you!

*All TVA EnergyRight rebate-eligible upgrades must be completed by a member of the Quality Contractor Network and meet TVA standards effective on installation date.

Energy efficiency upgrades plus rebates add up to big benefits.

*TVA EnergyRight and local power company service providers do not offer tax advice. Consult a tax professional to see if your home energy upgrades are eligible for federal tax credits.

**Financing may not be available in all service areas. Check with your local power company.

Ready for a rebate? Start by finding a TVA-vetted contractor.

Take the guesswork out of hiring a contractor with our “find a contractor” search tool. All TVA EnergyRight rebate-eligible home energy upgrades must be completed by TVA-vetted, licensed and insured contractors from our Quality Contractor Network. Already have your rebate code? Click on “Claim your rebate” to redeem.

Find out which upgrades can help you save the most on energy with our DIY Home Energy Assessment.

Saving energy means saving money. And we’re making it easier than ever to save both with our rebates and our free DIY Home Energy Assessment. Start the assessment today; it’s quick, easy and convenient!

Get energy-saving advice from your friends at TVA EnergyRight.

Visit our blog, The Current, to learn how TVA EnergyRight® and local power companies are working together to help you save on energy.

Financing available for home energy upgrades.

Affordable, $0 down financing may be available from your local power company for your home energy upgrades.

Get the FAQs about rebates, DIY Home Energy Assessments, the Quality Contractor Network and more!

Have questions about our rebates? What to see a list of all of our home energy rebate offerings? Need to learn more about financing? Get the answers to all this and more by visiting our Frequently Asked Questions page.

Rebates

Quality Contractor Network

Financing

Resources for all your home energy needs.

Check out these other helpful home energy services.

Energy-saving advice & education

Energy efficiency rebates